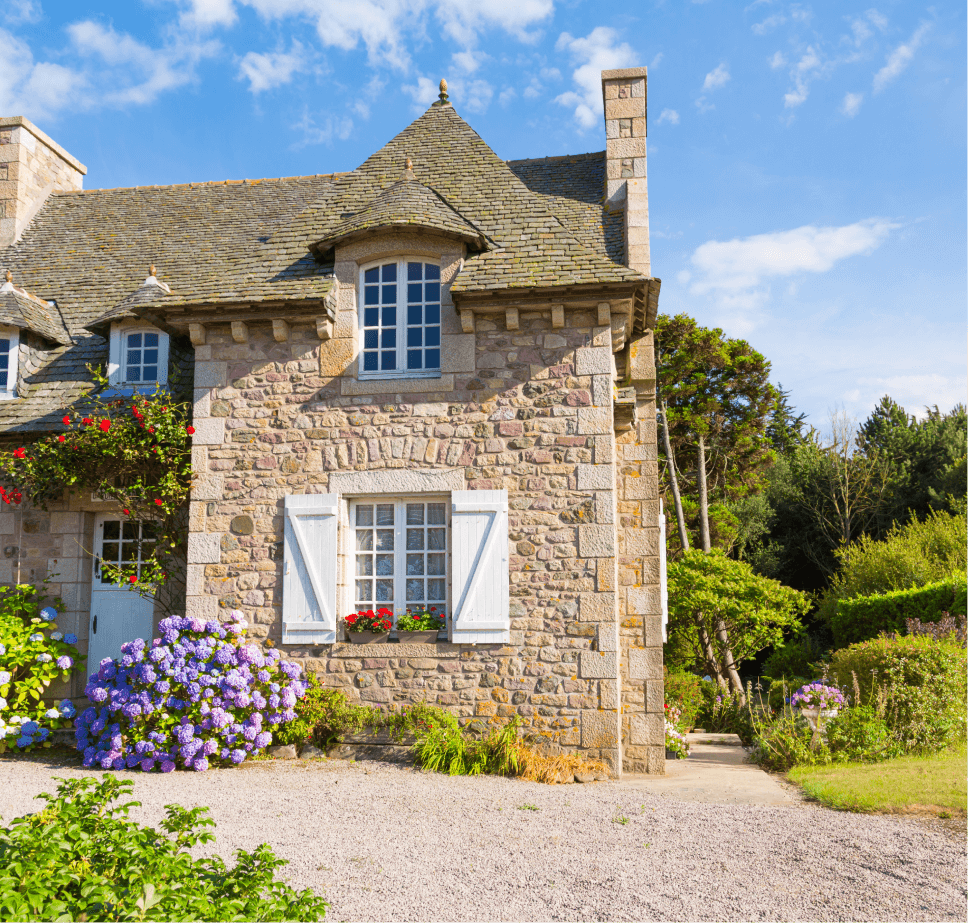

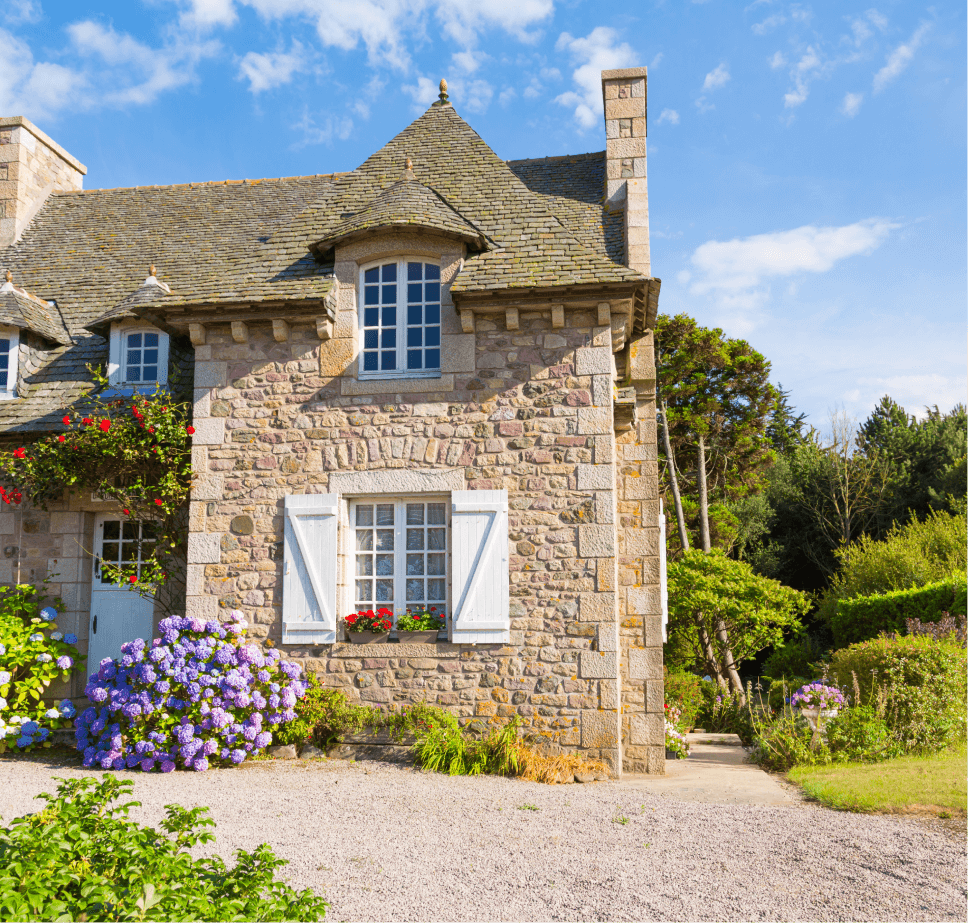

Is Your Listed Holiday Home Properly Protected?

A holiday home can be a profitable investment with a high return, especially if it’s located in one of the UK’s holiday hotspots like Devon, Cornwall, or the Lake District. Managed properly, it can deliver year-round revenue and a steady income.

However, there is plenty to think about before you rent your home out to paying guests or buy a listed property as your own private holiday home. That can include finding suitable insurance, which can be especially important if you have a Grade II listed property.

What Type Of Listed Buildings Are Covered?

We cover a range of cottages and houses with our listed building insurance cover, including private dwellings granted Grade II or Grade II* status. In Scotland, we can cover buildings granted B and C status.

Listed buildings include those classified as standard construction, as well as

-

Standard construction

-

Wattle and daub

-

Lathe and plaster

-

Timber framed Cob

Our Partners

Intasure works with trusted and established partners to provide flexible insurance options.

What Benefits Are Included In Insurance For Grade II Listed Buildings?

As well as providing you with cover for the building itself, our holiday home policies can include:

-

Accidental damage

Optional accidental damage cover for family and tenants

-

Theft

Optional theft by tenant cover

-

Loss of rent cover up to £25,000

for confirmed bookings following an insured loss under buildings cover

-

Alternative accommodation

cover following an insured loss under buildings cover

-

Accommodation

Emergency travel/accommodation cover – following an insured loss

-

Public liability

Public liability cover up to £5m

-

Outdoor swimming pools

Protection for outdoor swimming pools and hot tubs

Policy limits and exclusions may apply, please see the policy wording for full terms and conditions.

What If It’s Not Rented Out All-Year-Round?

We understand that this is a holiday home and there may be times when the property is left empty for a longer period. There are generally certain provisions for insurance for Grade II listed holiday homes that are not occupied all-year-round.

One provision may be that your holiday home does have to be occupied at least once during the year, and be in a habitable state and furnished to qualify as a holiday home. If you have any about our insurance requirements regarding occupancy, please don’t hesitate to call our team.

Is There Any Type Of Listed Holiday Home You Don’t Insure?

We do not offer cover for Grade I and Grade A listed properties or thatched properties.

A Team At The End Of The Phone

If you have any questions about our listed building holiday home insurance, you can give us a call. We’re here to help resolve problems and answer your questions about holiday home insurance for listed properties.

What Our Customers Say About Us

Why Choose Intasure For Listed Building Insurance?

If you’re new to listed building insurance, Intasure can help support you every step of the way. Our UK-based team has 20 years’ experience of guiding customers to a policy that meets their needs and budget. It’s why we’re rated Excellent on TrustPilot. Plus, we won’t charge you an admin fee if you ever change your mind and want to cancel your policy.

-

Cover overseas

We provide cover in more than 20 countries and territories

-

UK teams

We have an in-house UK-based customer service team

-

English documents

We provide all policy documents and communications written in English

-

Rated ‘Excellent’

We are rated ‘Excellent’ on TrustPilot, with a 4.5 star rating*

Specialist Second Home Insurance From Intasure

- Airbnb Insurance

-

Airbnb Insurance

Buildings and contents insurance suitable for holiday homes let via Airbnb

- Holiday Let Insurance

-

Find out more

Find out moreHoliday Let Insurance

Protection for your holiday home when it’s let to paying guests.

- Holiday Home Insurance

-

Find out more

Find out moreHoliday Home Insurance

Insurance for holiday homes in the UK and abroad.

- Holiday Cottage Insurance

-

Find out more

Find out moreHoliday Cottage Insurance

Protect your holiday cottage with suitable insurance.

Airbnb Insurance

Buildings and contents insurance suitable for holiday homes let via Airbnb

Holiday Let Insurance

Protection for your holiday home when it’s let to paying guests.

Holiday Home Insurance

Insurance for holiday homes in the UK and abroad.

Holiday Cottage Insurance

Protect your holiday cottage with suitable insurance.

Policy Documents

View our policy documents to discover the cover Intasure can provide.

View and Download