Block of Flats Insurance

Whether you're a landlord, investor, or property manager, you can help protect your block of flats with a specialist policy from Intasure.

What Is Block Of Flats Insurance?

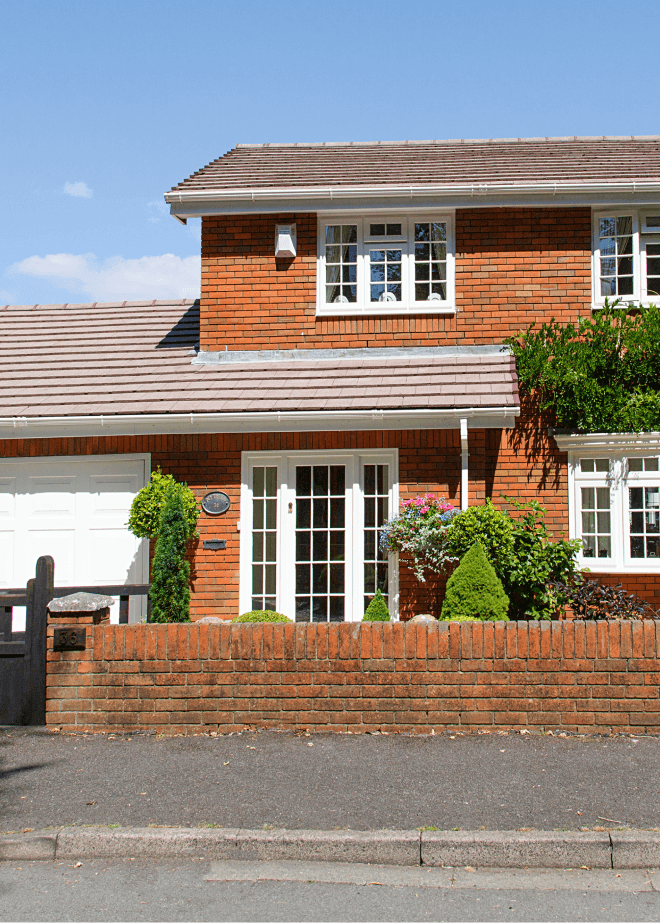

Block of flats insurance is building insurance for properties with multiple dwellings, like flats and apartments. Often called block insurance by insurers, it can cover anything from two flats in a converted house where leaseholders share freehold ownership, to large purpose-built blocks and converted buildings with many leaseholders. It’s designed to help protect the whole building, including you and your residents.

Who Needs Block Of Flats Insurance?

Block of flats insurance is an important consideration for building freeholders, including landlords, management companies, property owners, developers, property portfolio investors, and managers who own buildings containing flats. It can help protect the structure and communal areas against damages and liability claims, which your other insurance policies may not cover.

Our Partners

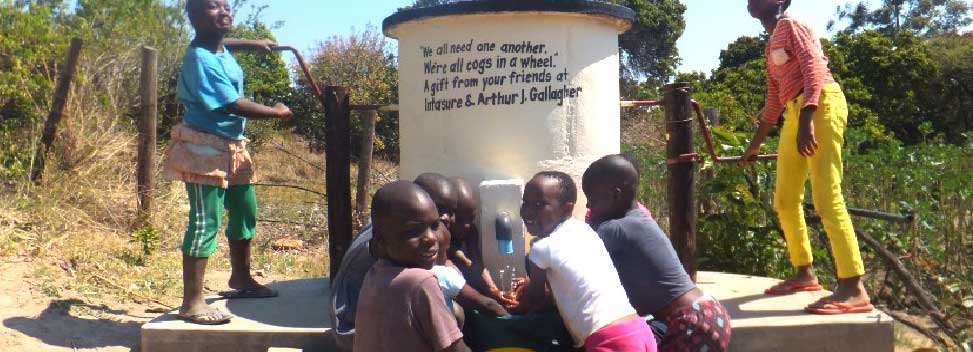

Intasure works with an established partner to provide flexible insurance options.

What Does Block Of Flats Insurance Cover?

We provide block of flats insurance that can include:

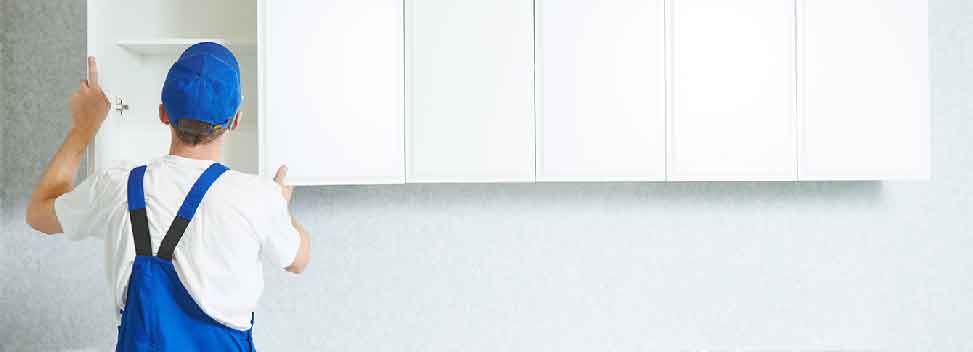

Building insurance

Our building insurance can cover the structure of your flat, including permanent fixtures such as built-in appliances, fitted kitchens, bathrooms, and other items that can’t be removed. It can also cover areas outside the parameters of the main building itself such as walkways, outbuildings and garages. Many mortgage providers insist you have flat building insurance as part of your mortgage terms and conditions.

Buildings insurance can provide cover for your flat from fire, flood, and other types of damage, but it doesn’t cover your possessions. For that, you’ll need contents insurance.

Contents insurance

Contents insurance can cover belongings in your flat, such as domestic furniture, technology devices, interior decoration, and other items. It can also insure against theft and damage, such as after a break-in.

Liability insurance

Liability insurance can protect you if someone gets injured while on your property or if you accidentally cause damage to someone else’s property. It can also help cover legal fees and compensation claims.

Loss of rent cover

Loss of rent cover can help to provide financial protection if your flat becomes uninhabitable due to an insured event, like a fire or flood. It helps to cover lost rental income and additional costs incurred while the property is being repaired.

These are brief product descriptions only. Please refer to the policy documentation paying particular attention to the terms and conditions, exclusions, warranties, subjectivities, excesses and any endorsements.

What Our Customers Say About Us

Why Choose Intasure For Block Of Flats Insurance?

With over 20 years of experience providing flat insurance, we’ve built a team of specialists to help you find block of flats cover that meets your needs.

-

We have an in-house, UK-based customer service and claims team

-

15 years of experience handling home and flat insurance

-

No additional administration fees are charged if you cancel

-

We provide cover in more than 20 countries and territories

-

We’re rated ‘Excellent’ on Reviews.io, with 95% of reviewers recommending us*

-

We provide all policy documents and communications in English

What Types Of Properties Can We Cover?

Intasure can cover a wide range of properties, including:

-

Domestic properties

-

Purpose-built blocks of flats

-

Converted properties

-

Listed buildings

-

Maisonettes

How To Arrange A Block Of Flats Insurance

Getting a quote with Intasure is easy. We’ll need:

- A few personal details, including your date of birth and occupation.

- Details about your property, including property type and

- The level of cover you need

FAQs

Please note that these frequently asked questions are not a substitute for the policy wording. For full terms and conditions, please see the policy documentation.

-

What does building insurance cover in a block of flats?

Building insurance for a block of flats can cover the property’s structural elements, including walls, roofs, and floors, against various risks such as fire, flood, and vandalism. It also typically includes coverage for windows, doors, and permanent fixtures like fitted kitchens and bathrooms.

This insurance usually includes protection against severe weather events, accidental damage, and incidents like subsidence or water escaping from pipes. Insurance often covers the cost of repairs and replacements, professional fees, and debris removal after an insured event.

-

Is block of flat insurance for tenants?

No, tenants typically need a contents-only policy. For more information, visit our home insurance page (link to be added when live).

* Correct as of September 2024

Get A QuotePolicy documents

View our policy documents to discover the cover Intasure can provide.

View and Download