Holiday Home Insurance In Scotland

- Tailor your Scotland holiday home insurance cover to suit your lifestyle

- Offers peace of mind to enjoy the leisure time you have earned

- 24/7 Scotland holiday home insurance emergency claims service

Protect Your Second Property With Holiday Home Insurance In Scotland

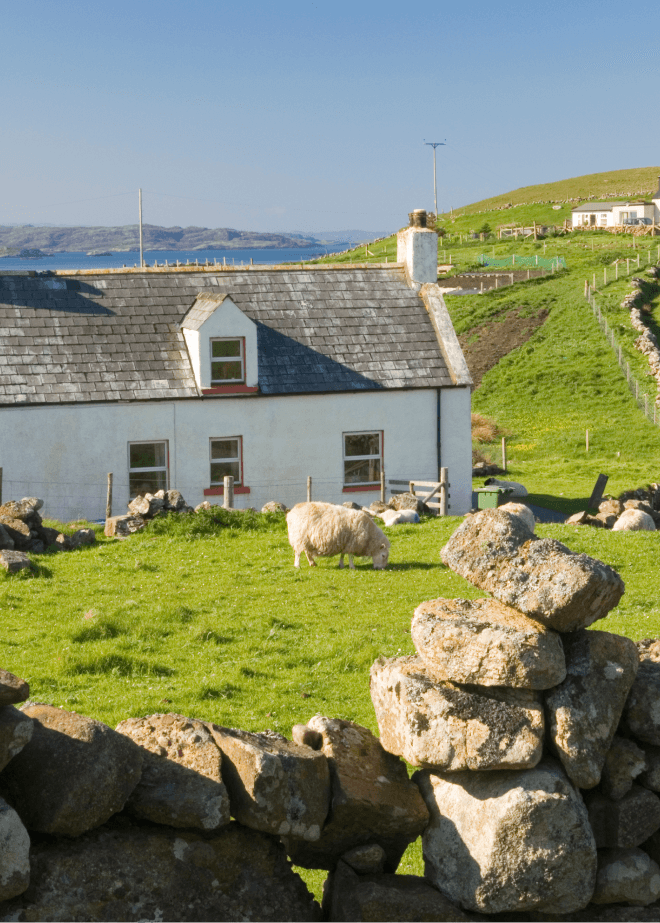

Glistening lochs, sprawling coastlines, imposing castles – it’s no wonder owning a holiday home in Scotland is a top choice for many.

Intasure’s holiday home and holiday let insurance can help to safeguard your property. To find out more about insuring your holiday home in Scotland, get a quote from us.

What Is Scotland Holiday Home Insurance?

Owning a home anywhere can come with risks, but these can be compounded when your second property isn’t within easy reach. For example, travelling to Scotland from other parts of the UK can take many hours. Therefore, you may want an insurance policy that can help even when you’re not close by.

That’s where our holiday home insurance can help. The policy includes buildings and contents insurance, providing protection designed specifically for second homes.

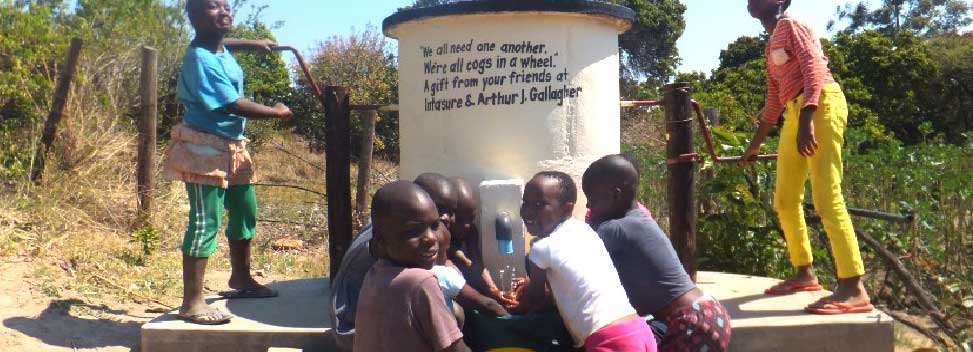

Our Partners

Intasure works with trusted and established partners to provide flexible insurance options.

Which Countries Are Covered By Holiday Home Insurance?

Our holiday home insurance is available in more than 20 countries and territories across Europe and beyond, including:

-

View a list of countries we cover

What Our Customers Say About Us

What Does Holiday Home Insurance In Scotland Cover?

If you have residential home insurance cover, you may be familiar with the buildings and contents protection included. Our Scotland home insurance policies can also cover damage and loss to buildings and contents.

These are brief product descriptions only. Please refer to the policy documentation paying particular attention to the terms and conditions, exclusions, warranties, subjectivities, excesses and any endorsements.

Buildings and contents cover

Our holiday home cover includes building and contents cover, as you might expect from a residential insurance policy.

Intasure holiday home insurance in Scotland covers:

-

Damage to buildings or contents due to natural disasters, such as flooding and fires

-

Escape of water or oil from household appliances, such as washing machines and dishwashers

-

Theft of household contents

-

Accidental damage to household goods, carpets, and sanitary fixtures

-

Loss or damage caused by electrical power surges

Public liability cover

Public liability cover can protect you against the financial risks of letting your holiday home to paying guests. In such scenarios, this cover offers protection in cases such as a guest suffering bodily injury whilst staying in your property, or if damage is caused to a third party property.

We offer £5 million cover as standard for insured public liability claims.

Emergency travel cover

Minor problems can quickly snowball into serious issues when you’re away from your property. That could be a leaking pipe leading to water damage, or storm damage rendering your home uninhabitable. If a disaster arises, our emergency travel insurance can help to reimburse you for travel costs when you need to get to your holiday home in a hurry.

Unoccupancy cover

Unoccupancy cover can help to relieve worries about your property when you’re out of the country. Subject to policy terms and conditions, we can cover your property year-round if you visit weekly, monthly, or just for a couple of weeks a year. For example, small issue like a leaky tap when you’re not there turning into escape of water can still be covered even when you’re not staying at the property.

What Property Types Are Covered?

Our Scotland holiday home insurance helps safeguard the following property types:

-

Farmhouses and cottages

-

Flats & apartments

Flats & apartments

-

Houses and bungalows

-

Caravans and park homes

Why Choose Intasure?

We have years of experience with insuring properties in Scotland. We’re UK-based, so you’ll have access to our English-speaking team when discussing your policy.

Here are the key benefits when choosing Intasure:

-

Customers can tailor insurance to their needs with optional covers

-

Up to £1 million buildings cover and £5 million public liability cover

-

Cover for short and long-term lets

-

Cover whether the property is occupied or not, for up to 60 days

-

Emergency travel costs for insured claims

-

Loss of rent cover following an insured claim

-

Alternative accommodation costs for insured claims

Holiday Home Insurance In Scotland FAQ

Please note that these frequently asked questions are not a substitute for the policy wording. For full terms and conditions, please see the policy documentation.

-

How much does holiday home insurance in Scotland cost?

While all insurance policies vary in cost, several factors typically shape the premium you pay, including:

- Your property’s location – for example, areas in close proximity to rivers, seas or other bodies of water, could result in higher premiums

- The size of your property – larger properties tend to attract higher premiums

- The contents within your property – storing high-value contents in your property can result in greater insurance costs

-

Do I legally need holiday home insurance for my Scottish property?

While it is not a legal requirement, holiday home insurance can help to protect you against risks that regular residential insurance might not. A policy can help to protect your investment from damage and theft. It also may be a requirement of your mortgage contract.

-

What level of cover should I get for my Scottish holiday home?

The level of cover you need depends on your circumstances. For instance, you could benefit from public liability insurance if you let your holiday home in Scotland for extra income. If you have any questions about the level of cover you need, get in touch with our friendly team.

-

Holiday home insurance vs home insurance – what is the difference?

Regular home insurance may not be appropriate to cover a holiday property. While it can include buildings and contents insurance, standard policies could leave you exposed. Our holiday home insurance includes public liability protection, which is a key consideration if you accept guests.

Policy Documents

View our policy documents to discover the cover Intasure can provide.

View and Download