Egypt Holiday Home Insurance

- Tailor your Egypt holiday home insurance cover to suit your lifestyle

- Offers peace of mind to enjoy the leisure time you have earned

- 24/7 Egypt holiday home insurance emergency claims service

Protect Your Second Property With Holiday Home Insurance In Egypt

If you have a holiday home in the land of the pyramids or you’re thinking about buying a place for your next adventure, you may want to explore our holiday home insurance options. The same goes for our holiday let insurance if you’re considering renting out your Egyptian home to guests.

Whether you’re looking for a grand seaside villa or a smaller modern apartment, Intasure offers insurance to help protect your property from potential risks. Whether it’s Sharm el-Sheik or the ancient city of Cairo that takes your fancy, see how we can with our specialist cover.

What Is Egypt Holiday Home Insurance?

Holiday home insurance in Egypt provides cover similar to standard home insurance, aside from one big difference. It can provide cover for risks more prevalent when holiday homes are left unoccupied for long periods.

For instance, if someone breaks into your property or severe weather conditions damage the structure of your house, holiday home insurance can act as a financial safety net. In essence, it considers more risks than a standard home insurance policy, helping to protect your most valuable assets from financial loss to contents damage.

Our Partners

Intasure works with an established partner to provide flexible insurance options.

Which Countries Are Covered By Holiday Home Insurance?

Our holiday home insurance abroad covers many common British tourist destinations, such as France and Spain. Looking to go somewhere further afield? We also offer policies for more exotic locations, such as Turkey.

-

View a list of countries we cover

What Our Customers Say About Us

What Does Egypt Holiday Home Insurance Cover?

Holiday home insurance can help safeguard your finances from several potential risks. At Intasure, we provide you with buildings and contents insurance as part of the same package, as well as public liability protection (which can be essential for those looking to welcome paying guests). We also offer several other forms of insurance, such as loss of rent and occupancy cover.

Whether you let your holiday home, lend it to friends and family, or use it for your own trips away, we provide an insurance policy that can help meet your requirements.

These are brief product descriptions only. Please refer to the policy documentation paying particular attention to the terms and conditions, exclusions, warranties, subjectivities, excesses and any endorsements.

Buildings and contents cover

This insurance can help protect your finances from any damage or loss inflicted upon your property or the contents inside. If you plan on spending extended periods away from your second home, buildings and contents insurance might be the minimum amount of cover you decide on.

Intasure buildings and contents cover for Airbnb properties can also include protection against the following risks:

-

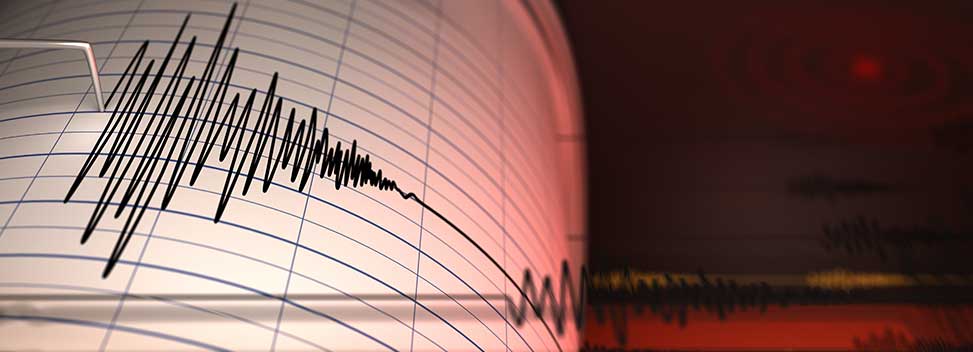

Damage to buildings or contents due to natural disasters, such as flooding and fires

-

Loss or damage caused by electrical power surges

-

Accidental damage to household goods, carpets, and sanitary fixtures

-

Escape of water or oil from household appliances, such as washing machines and dishwashers

-

Theft of household contents

Public liability cover

Public liability cover can protect you against the financial risks of letting your holiday home to paying guests.

We offer up to £5 million coverage for insured claims. In such scenarios, this cover offers protection in cases such as a guest suffering bodily injury whilst staying in your property, or if damage is caused to a third party property.

Emergency travel costs cover

Following a claim, our emergency travel cover can help with costs associated with travelling to your property in the event of a disaster. This protection could prove invaluable, for example, if severe weather damages the structural integrity of your house or a burst pipe leads to water damage. It’s just one of the ways we try to reduce the stress of owning a holiday home abroad.

Loss of rent cover

Loss of rent cover helps to ensure you don’t lose out on income from confirmed bookings if your holiday home isn’t fit for housing paying guests due to an insured event. Reasons could range from damage caused by severe weather to theft. If you are forced to cancel confirmed bookings, loss of rent cover can help to cover lost income.

Unoccupancy cover

Unoccupancy cover can help to relieve worries about your property when you’re out of the country. Subject to policy terms and conditions, we can cover your property year-round if you visit weekly, monthly, or just for a couple of weeks a year. For example, small issue like a leaky tap when you’re not there turning into escape of water can still be covered even when you’re not staying at the property.

What Sort Of Properties Does This Type Of Insurance Cover?

Whether you’re lucky enough to own a substantial seaside villa or a beachfront apartment, Intasure covers several property types in Egypt, including:

Why Choose Intasure For Your Holiday Home?

We have years of experience with insuring properties in Egypt. What’s more, we’re UK-based, so you’ll have access to our English-speaking team when discussing your policy.

Key benefits of insuring your holiday home with Intasure:

-

Customers can tailor insurance to their needs with optional covers

-

Up to £1 million buildings cover and £5 million public liability cover

-

Cover for short and long-term lets

-

Cover whether the property is occupied or not, for up to 60 days

-

Emergency travel costs for insured claims

-

Loss of rent cover following an insured claim

-

Alternative accommodation costs for insured claims

Holiday Home Insurance Egypt FAQ

Please note that these frequently asked questions are not a substitute for the policy wording. For full terms and conditions, please see the policy documentation.

-

How much does Egypt holiday home insurance cost?

Several factors impact the cost of holiday home insurance, including:

Your property’s location– for example, areas in close proximity to rivers, seas or other bodies of water, could result in higher premiums

The size of your property– larger properties tend to attract higher premiums

The contents within your property– storing high-value contents in your property can result in greater insurance costs -

Will a standard home insurance policy cover holiday homes?

The risks associated with owning a holiday home are typically greater than those surrounding a primary residence. This is partly due to long periods of unoccupancy. You may also want to consider public liability, loss of rent, unoccupancy cover, and emergency travel costs protection.

-

What insurance do I need for a holiday let in Egypt?

If you are thinking about purchasing a second home in Egypt as a buy to let, you may want to include public liability. In doing so, it can help to safeguard your finances against the potential risks associated with having holidaymakers stay at your property. Protection against accidental damage and theft are included within our overseas holiday home insurance.

-

Is holiday home insurance mandatory in Egypt?

Holiday home insurance isn’t mandatory in Egypt. However, it could prove invaluable if you plan to spend periods away from your property.

Policy Documents

View our policy documents to discover the cover Intasure can provide.

View and Download