Airbnb Insurance

- Tailor your Airbnb insurance cover to suit your lifestyle

- 24/7 Airbnb insurance claims service

Insurance For Airbnb Lets

Airbnb properties are available around the world, making it easy for holidaymakers to stay in extraordinary settings with their favourite home comforts. Moreover, for willing property owners, it can present a lucrative revenue stream.

However, opening your doors to strangers can also come with risks. At Intasure, our Holiday Home Insurance is suitable for a range of property types and uses, including those let via platforms such as Airbnb. So, if you’re renting out a property, you may first want to consider this type of Airbnb insurance for extra protection on top of what is provided by Airbnb’s AirCover.

This form of property insurance can help protect you from the financial perils associated with renting out a property in a prime spot, like a city centre or popular holiday location.

Want to find out more about how we can provide Airbnb insurance for holiday homes? Keep on reading.

What Is Airbnb Insurance?

Allowing unknown guests into your property can pose many risks, especially if you’re not there to host. That’s where Airbnb insurance cover can help. Our holiday home insurance can help to safeguard your Airbnb let if the building or your contents are damaged. It can also help to provide financial protection in the event of a guest making an insured claim against you for injury. What’s more, this type of Airbnb insurance can offer financial support in circumstances where there’s a loss of rent if the property is uninhabitable due to an insured event.

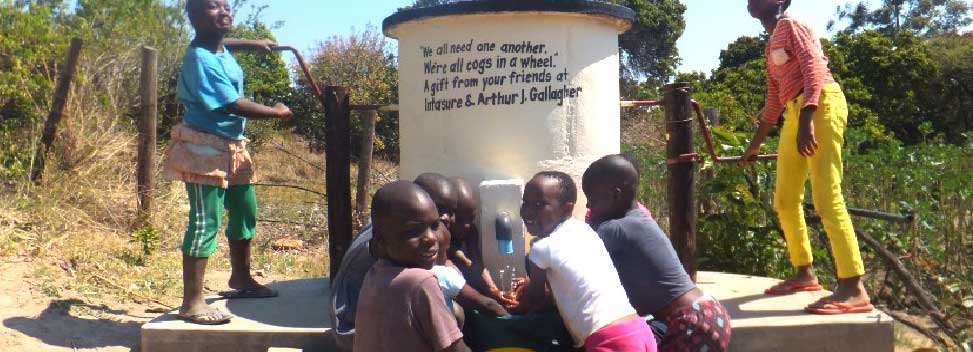

Our Partners

Intasure works with an established partner to provide flexible insurance options.

Which Countries Are Covered By Holiday Home Insurance?

You shouldn’t feel restricted when buying a second home. This is a chance for you to secure your dream holiday home, after all! That’s why we’ve extended our holiday home insurance to cover more than 20 countries and territories across the EU and beyond, covering many popular British tourist destinations. What’s more, our customer service is handled by a UK-based, English-speaking support team, to help you find the information you need.

Our holiday home insurance abroad covers many common British tourist destinations, such as France and Spain. Looking to go somewhere further afield? We also offer policies for more exotic locations, such as Turkey. Here’s our complete list of destinations:

-

View a list of countries we cover

What Our Customers Say About Us

What Can Property Insurance For Airbnb Hosts Cover?

What can property insurance for Airbnb hosts cover?

At Intasure, our policies extend to Airbnb properties of all sizes, from single rooms to substantial holiday homes, safeguarding their hosts.

Buildings and contents insurance

Like standard home policies, Airbnb insurance cover can help to protect a building’s structure and the contents within. Damage caused to your property can be one of the biggest worries for anyone renting a home out as an Airbnb. For your Airbnb contents, insurance can help to provide reassurance that your possessions and assets can be covered with accidental damage protection.

Intasure buildings and contents cover for Airbnb properties can also include protection against the following risks:

-

Damage to buildings

due to natural disasters such as floods or storms

-

Loss or damage

to buildings caused by falling aerials, solar panels, satellite dishes, and fittings.

-

Accidental damage

to underground services to the holiday home for which you are legally responsible.

-

Public liability cover

of up to £5 million.

-

Protection

against damage during short or long-term lettings.

-

Theft

of personal property, money (up to £250), or valuables.

-

Accidental damage

to household goods such as fixed glass and sanitary fixtures.

Public liability cover

Public liability cover can help to protect you financially. Paying guests will be staying at your property, and with public liability covering up to £5 million, it can help to safeguard your finances if your guests pursue compensation for injury or damage to their belongings sustained while staying in your property.

Loss of rent cover

Additionally, if damage renders your property uninhabitable, you could face the unenviable prospect of losing out on expected rent. Many Airbnb hosts rely on a steady stream of income from paying guests to contribute towards their mortgage bills or to fund their lifestyle, so the idea of losing out on rent is stressful.

With loss of rent cover, if an insured incident, such as a burst pipe, causes damage that prevents your guest from staying in the property, you can be covered for the income you would have made from your Airbnb guests.

Insurance for short-and long-term lets

Intasure can protect short-term rentals and long-term stays alike, up to twelve months for the latter.

Why Choose Intasure For Your Holiday Home?

As a relatively new form of renting, many budding landlords may need more information about what cover is available before renting out an Airbnb property, which is where we can help.

Benefits of using Intasure for your holiday home insurance:

-

Building insurance up to £1 million

-

Public liability cover up to £5 million included as standard

-

Property cover whether occupied or unoccupied

-

We’re a specialist holiday let insurer

-

Understanding of local rules and regulations.

-

Experienced English speaking customer service staff

-

Flexible policies tailored to customers through optional extras

What Sort Of Properties Does This Type Of Insurance Cover?

Airbnb Insurance cover can provide protection for a wide range of properties both in the UK and overseas, including:

-

Log cabin

Log cabin

-

Flats & apartments

-

Holiday homes

Holiday homes

-

Holiday chalet

Holiday chalet

-

Listed home

Listed home

Policy Documents

View our policy documents to discover the cover Intasure can provide.

View and DownloadProperty Insurance For Airbnb Hosts FAQ

Please note that these frequently asked questions are not a substitute for the policy wording. For full terms and conditions, please see the policy documentation.

-

How do I make a claim?

To make a claim, contact us on our 24-hour hotline: +44 (0)345 111 0672.

-

How much does this type of Airbnb insurance cover cost?

Many factors affect the cost of Airbnb insurance cover, including:

- Size – larger properties, such as listed homes, may have higher premiums than smaller properties.

- Age – insurers are more cautious about older properties.

- Contents – high-value items inside your property may push up your premium..

- Value and rebuild cost – as with residential home insurance, properties with a larger footprint tend to reflect higher premiums. The cost of rebuilding your property is factored in, too. Therefore, your premiums could be higher if your property is constructed with rare or expensive construction materials.

-

Do I need additional Airbnb insurance on top of the existing cover offered by Airbnb?

Airbnb AirCover is a free insurance programme from Airbnb*. However, the cover may not provide enough for your needs and some areas may leave hosts exposed.

For example, AirCover provides $1 million USD liability insurance cover, whereas a policy from Intasure includes liability insurance cover up to £5 million GBP as standard.